Table of Content

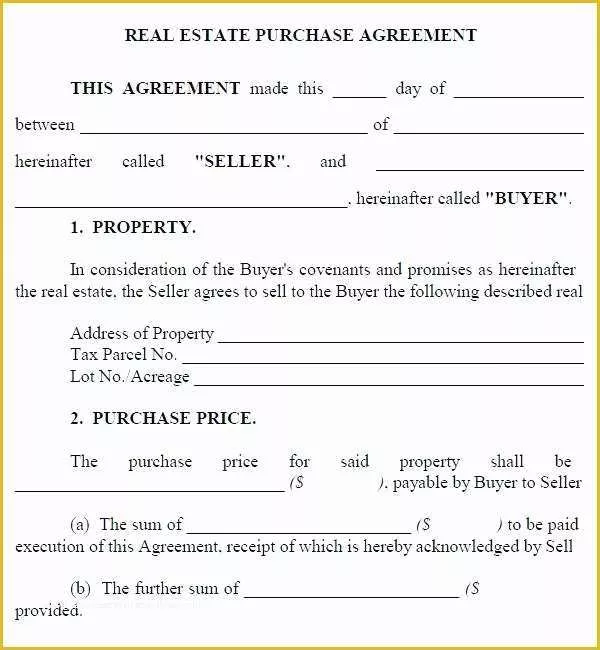

For this reason, sellers should use the financing agreement to protect themselves from unknowns and set clear expectations for the buyer. This can involve detailing what constitutes late payment, whether there is a grace period and what happens in the case of borrower default. An owner financing contract can also provide a tax advantage to the owner and the buyer. This section states, in detail, the interest payment and surrounding charges. Information about the interest rate and time are also included in this section.

Referred to as a “Conditional Lien Release,” the contractor is essentially waiving his or her rights to filing a Mechanics Lien against your property for that portion of the job for which you are paying. “Conditional” as it is based on payment being satisfied, such as the check clearing your bank and the contractor receives payment. Should the contractor dispute being paid for the work, the homeowner has proof in the form of a signed release from the contractor, along with a cancelled check.

What Is The Owner Financing Contract?

An owner financing contract hereby provides proof and clarity in this regard. While it’s not common, under the right circumstances, seller financing can be a good option for buyers and sellers. Still, there are risks for both parties that should be weighed carefully before signing any contracts. A home is typically the largest single investment that a person ever makes, and the process is challenging for anyone, particularly a first-time home buyer. Because of the hefty price tag, there’s almost always some type of financing involved, usually a mortgage. One alternative to a mortgage is owner financing, which happens when a buyer finances the purchase directly through the seller, instead of going through a conventional mortgage lender or bank.

The last thing anyone wants to do during a renovation is pursue legal action against a bad contractor. Whether it’s because of unfinished work, a disagreement on payment terms, or another difficult scenario, it’s certainly a harrowing experience for any homeowner considering involving a lawyer. At closing, the buyer receives title to the home that is subject to a mortgage held by the seller. After five years of on-time monthly payments, the buyer makes the final balloon payment and the mortgage lien is released. Advantages of buying an owner-financed home In a seller-financed transaction there are no closing costs such as loan origination fees, discount points and mortgage insurance premiums.

How to Avoid Taking Legal Action

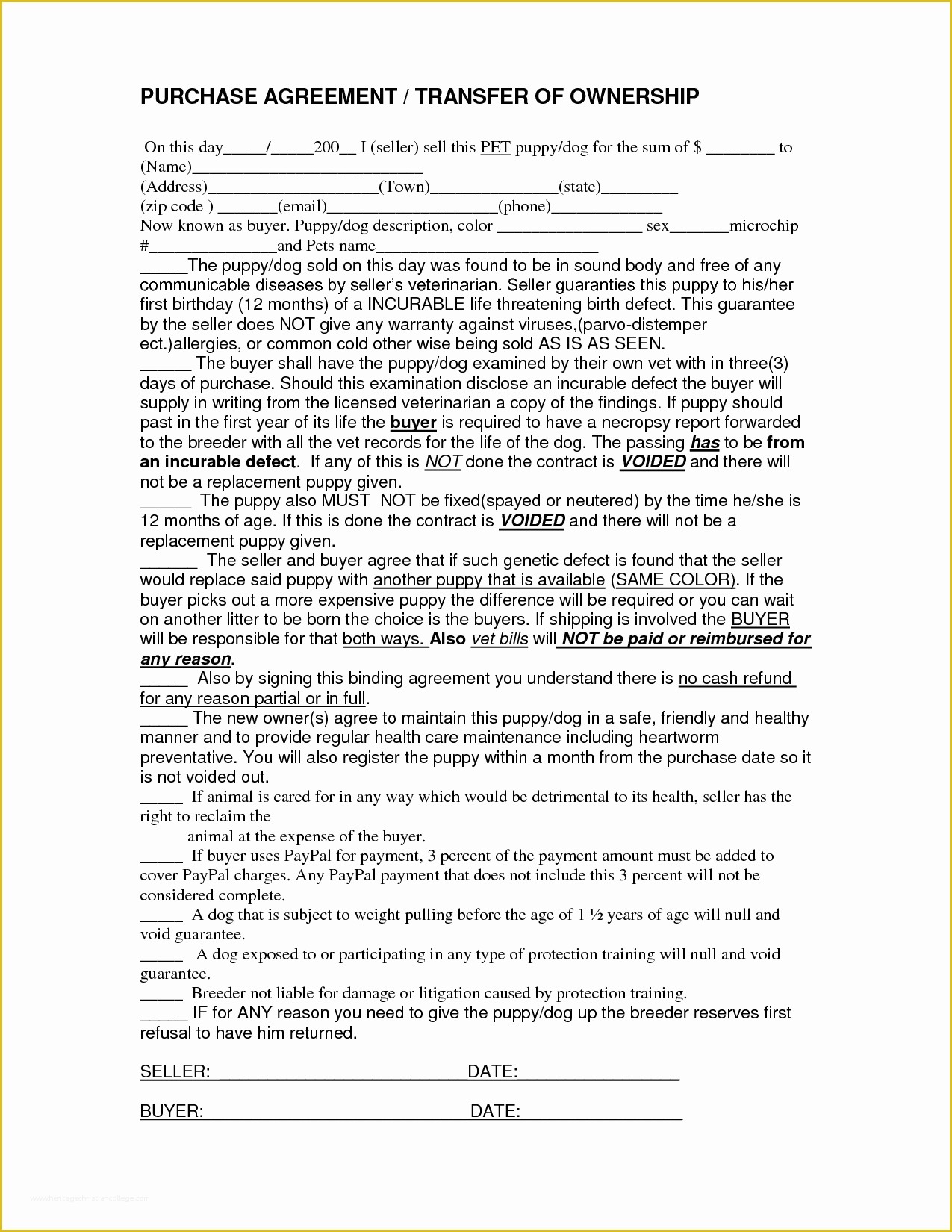

Unlike most sale agreements, this is a situation where, a part or whole of the financing for the property for the buyer, is provided by the seller. Often project changes implemented during construction will add onto the total project cost and this can cause disagreements. This is why your contract should have a “change order procedure,” which details the way in which both parties need to go about adding on any changes to the original construction plan. Likewise, an owner financing agreement should list how much the buyer is contributing as a down payment at closing. If there was an earnest money deposit, this amount should also be included in the agreement. CocoSign represents a wide collection of legal templates covering all types of leases, contracts and agreements for personal and commercial use.

Above all, we’d recommend consulting an experienced, practicing attorney to make any sort of decision. However, there are a few tips from Charles that may help you think more clearly about your own project, based on cases he’s dealt with in the past. Well, for one, home improvement projects are a huge financial investment. While other complaints about car troubles or shopping purchases are certainly common, home improvement projects are generally much more expensive. In fact, home improvement and construction projects took the #1 spot for worst consumer complaint of 2019. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

Draft a Contract for Deed

Most real estate contracts are recorded on title and the buyer is recorded as a contact owner. A real estate contract does not have to be recorded for it to be valid. However, it is highly recommended and in the buyer's best interest to have the contract recorded on title. It also makes it easier for the buyer to obtain a loan in the future to pay off the contract from a lender because it shows a clear recorded record of when the property was purchases on contract. Most owner-financing deals are short-term loans with low monthly payments.

Another perk for sellers is that they may be able to sell the home as-is, which allows them to pocket more money from the sale. A judge in small claims court won’t be able to order a contractor to finish a job - all they can do is issue an order to pay a certain amount of money. Every state has a maximum amount of money you can claim - and it varies greatly from state to state.

Ask simple questions about the law in Australia to get pointed in the right direction for real advice. The cooling off period starts as soon as you have received the contract. Please contact the moderators of this subreddit if you have any questions or concerns.

In the end, it is the homeowners’ responsibility to make sure that they are protected and not vulnerable to potentially serious problems and unethical contractors. This is a great way to mitigate risk of legal issues down the road. But also know that unethical contractors can file mechanics liens against homeowners who may dispute a “surprise invoice” for work they never authorized or were unaware of being performed.

Over the course of the loan, the buyer makes monthly payments of $426 and is responsible for property tax and insurance payments. Owner financing—also known as seller financing—lets buyers pay for a new home without relying on a traditional mortgage. Instead, the homeowner finances the purchase, often at an interest rate higher than current mortgage rates and with a balloon payment due after at least five years. An attorney usually prepares the real estate contract for both parties to sign.

All legal templates available on CocoSign shall not be considered as attorney-client advice. Meanwhile, CocoSign shall not be responsible for the examination or evaluation of reviews, recommendations, services, etc. posted by parties other than CocoSign itself on its platform. One of the primary reasons an owner financing contract is used is to ensure that the exchange of property takes place over a loan provided by the seller to the buyer. This documents the whole arrangement against doubt and ambiguity in the future.

UpCounsel is an interactive online service that makes it faster and easier for businesses to find and hire legal help solely based on their preferences. We are not a law firm, do not provide any legal services, legal advice or "lawyer referral services" and do not provide or participate in any legal representation. These conflicts can often lead to confusion and, ultimately, a disagreement.

Keep in mind, however, that these may be restricted by federal law. Just like a conventional mortgage, owner financing involves making a down payment on property and paying off the rest over time. That said, this alternative to traditional financing is typically more expensive and requires repayment or refinancing into a traditional loan in as little as five years. Still, seller financing is usually faster and easier to get than a government-backed mortgage—if the seller is willing and able to provide it. If you’re in the market for a new home but are having trouble winning loan preapproval, owner financing is an alternative that can keep your dream of homeownership within reach. Though not all sellers will be willing—or able—to provide direct financing to the buyer, it can be an excellent way to buy a property while also simplifying the closing process.

Use your accounts to appear throughout the lawful varieties you might have ordered formerly. Proceed to the My Forms tab of your own accounts and get yet another backup of the document you need. Download, print or share the agreement document as a professionally formatted PDF document with your company logo. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Visit our attorney directory to find a lawyer near you who can help. This is to prevent a person from cheating someone else by claiming a breach of a "fraudulent oral contract," which means a spoken agreement that isn't actually legal in court. The Home Owner Contract has been designed for people looking for the benefits and protection of a contract when appointing contractors to carry out their building work. Find more luxury, lakefront, winter, & last-minute cottage rentals near Middelburg.